|

Zelle ★ 3.8 |

|---|---|

| ⚙️Developer | Early Warning Services, LLC |

| ⬇️Downloads | 10,000,000+ |

| 📊Category | Finance |

| 🤖Tags | zelle | bank | banking |

The Zelle App is a popular peer-to-peer payment platform that allows users to send and receive money quickly and securely. With Zelle, users can easily transfer funds to family, friends, or anyone else with a U.S. bank account. The app offers a convenient and hassle-free way to split bills, pay for services, or send money for any other reason. With its user-friendly interface and widespread availability, Zelle has become a go-to app for seamless money transfers.

Zelle is supported by numerous major banks and financial institutions, making it accessible to a wide range of users. The app leverages the existing infrastructure of participating banks, ensuring that transactions are processed securely and efficiently. Whether you need to pay someone back or receive money, Zelle makes it simple and convenient.

Features & Benefits

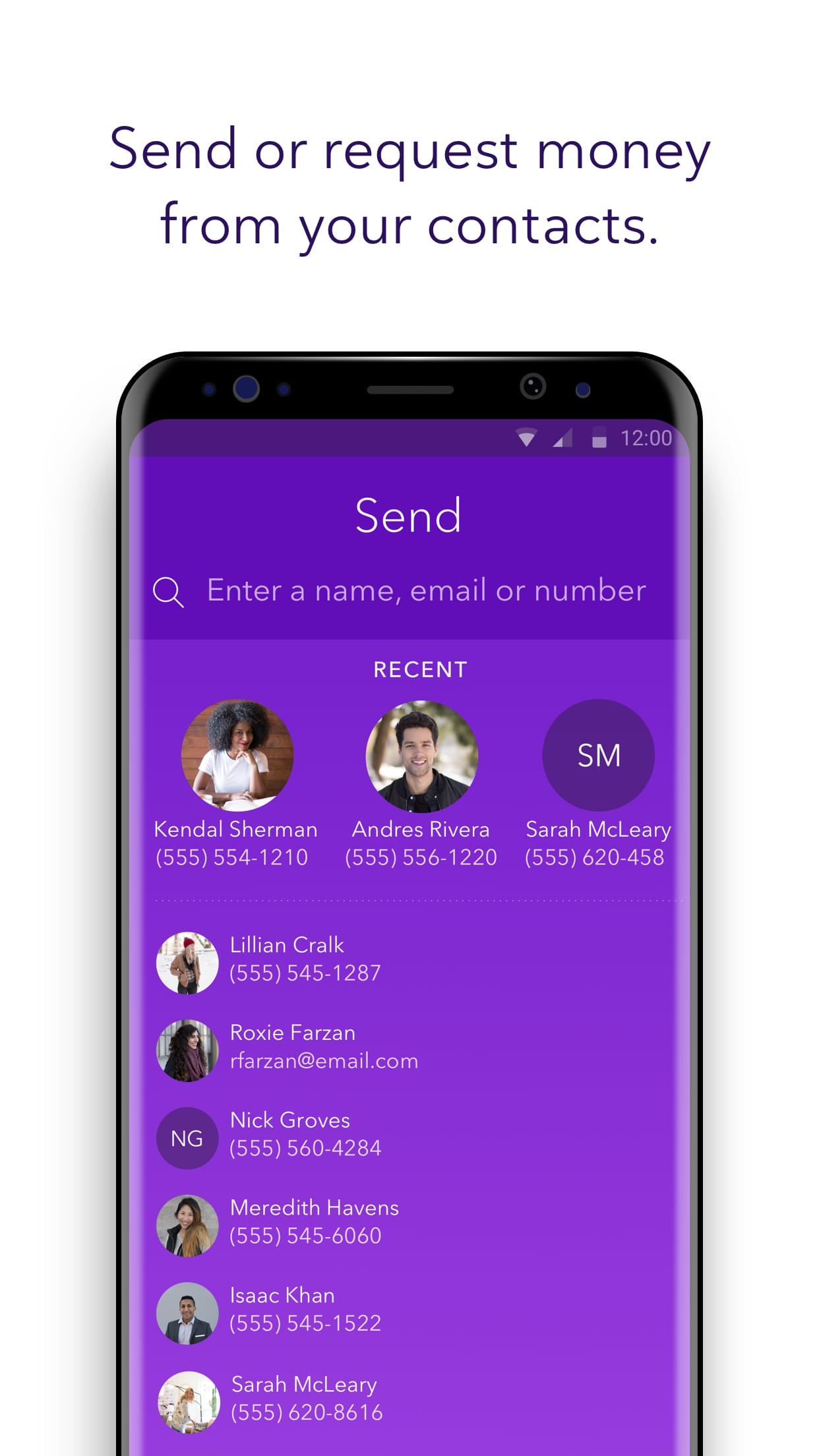

- Quick and Easy Transfers: With the Zelle App, users can send and receive money with just a few taps on their smartphone. The app is designed for simplicity and speed, allowing users to complete transactions within minutes. Users can send money using just the recipient’s email address or mobile number, eliminating the need to exchange account information.

- Broad Bank Support: Zelle is supported by a wide network of banks and financial institutions, making it accessible to a large user base. Users can link their existing bank accounts to the Zelle App and seamlessly transfer funds between participating banks. This broad support ensures that users can send and receive money without limitations caused by bank affiliations.

- Real-Time Transactions: Zelle enables real-time money transfers, providing instant access to funds. Once a transaction is initiated, the recipient typically receives the funds within minutes. This feature is particularly useful for urgent payments or when immediate access to funds is required.

- Security and Fraud Protection: Zelle prioritizes the security of user transactions. The app utilizes advanced encryption and authentication protocols to safeguard user information. Additionally, Zelle’s fraud prevention measures help protect users from unauthorized transactions, providing peace of mind while using the app.

- No Fees: One of the significant advantages of the Zelle App is that it does not charge any fees for sending or receiving money. Users can transfer funds without incurring additional costs, making it an attractive option for those looking for a cost-effective peer-to-peer payment solution.

Pros & Cons

Zelle Faqs

Zelle is a digital payment platform that enables users to send and receive money directly between bank accounts, typically within minutes. It operates through a network of participating banks and credit unions, allowing users to transfer funds using only an email address or mobile phone number. Users link their Zelle account to their bank account through their bank¡¯s app or website, making transactions seamless and straightforward. Yes, there are limits on the amount you can send using Zelle, which can vary depending on your bank or credit union. Most financial institutions have daily and monthly limits for sending money via Zelle. For example, some banks may allow you to send up to $500 per day, while others might have higher or lower limits. It¡¯s essential to check with your specific bank to understand their policies regarding transaction limits. No, Zelle is designed for domestic transactions only and cannot be used for international money transfers. Both the sender and receiver must have U.S. bank accounts, and Zelle does not support payments to or from accounts outside the United States. For sending money internationally, consider other platforms specifically designed for that purpose. Zelle does not charge users any fees for sending or receiving money. However, some banks might impose their own fees for certain transactions or services. It¡¯s advisable to contact your bank to confirm if they charge any fees related to Zelle transactions before proceeding with your payments. If you mistakenly send money to the wrong recipient, act quickly. Zelle transactions are typically irreversible, but you can try contacting your bank immediately for assistance. They may be able to help you recover the funds if the recipient has not yet claimed them. If the incorrect recipient is a trusted contact, reach out to them directly and request the return of the funds. Once a payment has been sent through Zelle, it cannot be canceled if the recipient has already enrolled in Zelle and accepted the payment. However, if the recipient has not signed up for Zelle yet, you may have the option to cancel the transaction through your banking app. Always check your bank’s guidelines for canceling transactions to ensure proper action. Yes, Zelle takes security seriously and employs encryption and various security measures to protect users’ personal information. However, users must also take precautions by only sending money to known individuals and being cautious about sharing their Zelle details. Avoid using Zelle for transactions with strangers or unverified parties to minimize risks. If you encounter problems with a payment, such as delays or failed transactions, first check your internet connection and ensure your app is updated. If everything seems fine, contact your bank’s customer service for assistance. They can investigate the issue further and provide guidance on resolving it. Additionally, if you suspect fraud or unauthorized transactions, notify your bank immediately.What is Zelle and how does it work?

Is there a limit to how much money I can send using Zelle?

Can I use Zelle internationally?

Are there any fees associated with using Zelle?

What should I do if I sent money to the wrong person?

How do I cancel a payment made through Zelle?

Is my personal information safe when using Zelle?

What happens if I experience issues with a payment made through Zelle?

Alternative Apps

- Venmo: Venmo is another widely used peer-to-peer payment app that allows users to send and receive money with ease. It offers social features, allowing users to share payment activities with their friends and add comments to transactions. Venmo is known for its user-friendly interface and seamless integration with social media platforms.

- Cash App: Cash App, developed by Square Inc., is a popular mobile payment app that enables users to send and receive money quickly. It also offers additional features such as the ability to invest in stocks and buy and sell Bitcoin. Cash App has gained popularity for its simplicity and versatility.

- PayPal: PayPal is a well-established online payment platform that offers a range of services, including peer-to-peer transfers. Users can send money to others using their email address or mobile number. PayPal is widely accepted and offers international support, making it a suitable alternative for users who require cross-border transactions.

While these apps share similarities with Zelle, each has its own unique features and advantages. Users should consider their specific needs and preferences when choosing the most suitable peer-to-peer payment app for their requirements.

Screenshots

|

|

|

|