| Afterpay ★ 3.8 |

|

| ⚙️Developer | Afterpay |

| ⬇️Downloads | 10,000,000+ |

| 📊Category | Shopping |

| 🤖Tags | shopping | finance | installment payments |

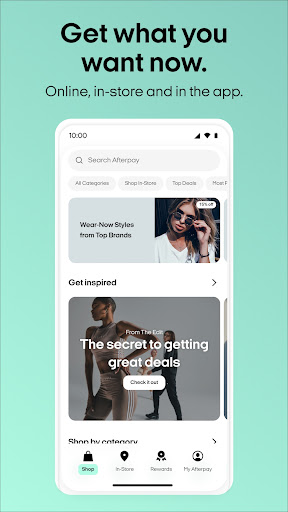

In the era of digital commerce, the Afterpay app has emerged as a game-changer, revolutionizing the way consumers shop and pay for their purchases. Afterpay offers a “buy now, pay later” service that allows users to make purchases instantly and pay for them in interest-free installments over time. With its seamless integration into online and physical stores, Afterpay provides a convenient and flexible shopping experience. This article delves into the features, benefits, pros, and cons of the Afterpay app, shedding light on how it has transformed the way we shop.

Features & Benefits

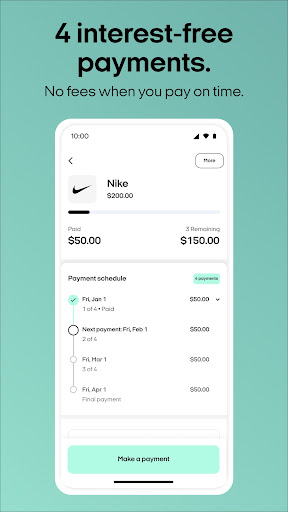

- Convenient Payment Options: Afterpay app provides users with a convenient alternative to traditional payment methods. It allows shoppers to split their purchases into four equal installments, paid every two weeks, without any interest fees. This flexibility makes it easier for users to manage their budgets and make purchases without the burden of large upfront payments.

- Instant Approval and Setup: The Afterpay app streamlines the payment process by offering instant approval and setup. Users can create an account within minutes, link their preferred payment method, and start using Afterpay immediately. The app’s user-friendly interface ensures a seamless onboarding experience, enabling shoppers to make purchases swiftly.

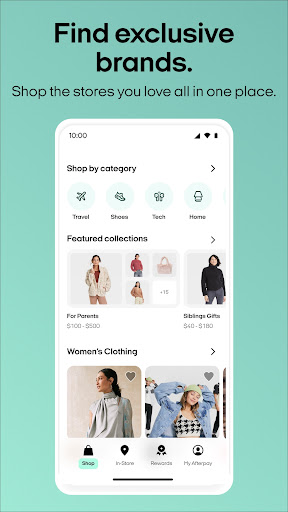

- Wide Merchant Acceptance: Afterpay has established partnerships with numerous online and physical retailers, making it widely accepted across various industries. From fashion and beauty to electronics and home goods, the app allows users to shop at their favorite stores and enjoy the convenience of the “buy now, pay later” model.

- Budgeting and Financial Control: The Afterpay app comes with built-in budgeting tools that empower users to stay on top of their spending. It provides clear visibility into upcoming payment due dates and allows users to set up personalized spending limits. These features help users manage their finances responsibly and avoid overspending.

- Enhanced Shopping Experience: By integrating seamlessly with online stores, Afterpay enhances the overall shopping experience. Users can view and manage their purchases, track deliveries, and even receive personalized offers and promotions from partnered merchants. The app creates a cohesive and convenient shopping ecosystem for users.

Pros & Cons

Afterpay Faqs

Afterpay is a payment service that allows customers to shop online or in-store and pay for their purchases in four equal installments, due every two weeks. Once a customer selects Afterpay at checkout, they complete the transaction by paying the first installment upfront. The remaining three payments are automatically deducted from their linked debit or credit card over the following six weeks. This service helps consumers manage their spending without incurring interest when payments are made on time. To set up an Afterpay account, you need to visit the Afterpay website or download the Afterpay app. After providing your email address and creating a password, you’ll be asked to enter some personal details, including your name, date of birth, and payment information. Afterpay then performs a quick approval process based on your financial history. Once approved, you can start using Afterpay at any participating merchant. While Afterpay does not charge interest if payments are made on time, late payments will incur fees. Each missed payment can result in a fee ranging from $8 to $15, depending on your location. Additionally, Afterpay may restrict your spending limit if multiple late payments occur. It¡¯s important to monitor your payment schedule and make timely payments to avoid these fees. Yes, Afterpay can be used for international purchases, but only at select retailers that offer this payment option across borders. When shopping internationally, ensure that the retailer supports Afterpay for your country. Currency conversion may apply, and all transactions must comply with Afterpay’s terms and conditions, which vary by region. If you decide to return an item bought through Afterpay, you should follow the retailer¡¯s return policy. Afterpay will process the refund according to the retailer¡¯s procedures, and you will no longer be responsible for the remaining payments related to the returned item. Refunds are typically issued back to the original payment method used during the purchase. It¡¯s advisable to keep track of your order and payment details throughout the return process. You cannot directly change the payment method for ongoing Afterpay installments once the purchase is completed. However, you can update your payment information for future transactions. To do this, log into your Afterpay account and navigate to your account settings, where you can add a new card or update your existing payment information for upcoming purchases. Yes, Afterpay imposes a spending limit that varies based on your individual payment history and the retailer’s policies. New users may start with a lower limit that increases as you demonstrate responsible repayment behavior. If you miss payments or fail to repay on time, your spending limit may decrease. Afterpay continuously evaluates your usage patterns to determine your eligibility for higher limits. To reach Afterpay customer service, you can visit their official website and navigate to the help section, where you¡¯ll find various support options such as live chat, email, or phone support. They also have a comprehensive knowledge base that addresses common queries. Make sure to provide relevant details about your issue to receive prompt assistance.What is Afterpay and how does it work?

How do I set up my account with Afterpay?

Are there any fees associated with using Afterpay?

Can I use Afterpay for international purchases?

What happens if I want to return an item purchased with Afterpay?

Can I change my payment method for Afterpay installments?

Is there a spending limit with Afterpay?

How do I contact Afterpay customer service for issues?

Alternative Apps

ZipPay:?ZipPay offers interest-free installment payments for online and in-store purchases. It provides users with a digital wallet and a reusable line of credit, making it easy to manage and control their spending.

Splitit:?Splitit allows users to split their purchases into interest-free installments using their existing credit cards. It requires no application or credit check and provides a seamless and convenient payment solution.

Quadpay:?Quadpay offers a “split it” payment option, allowing users to divide their purchases into four interest-free payments. The app is widely accepted at a range of retailers and offers a simple and transparent payment experience.

PayPal Credit:?PayPal Credit provides users with a line of credit that can be used for online purchases. It offers promotional financing options and flexible repayment terms, making it a popular alternative to traditional credit cards.

Affirm:?Affirm offers transparent and flexible financing options for online purchases. Users can choose from multiple repayment plans, including interest-free options, and enjoy a straightforward and user-friendly experience.

Screenshots

|

|

|

|